Utilities and ESG

How utilities can turn ESG reporting into a strategic advantage

Institutional investors, ratings agencies and consumers want better reporting on corporate environmental, social and governance (ESG) performance. Few industries feel the pressure more than utilities, which are essential to decarbonization efforts and highly exposed to climate-related risks, from violent storms and flooding to forest fires. In this brief paper, we discuss the challenges and opportunities of ESG reporting for utilities and provide a practical analysis of the major reporting regimes. Our goal is to help utilities embrace the spirit of ESG as they master the intricacies of reporting, use ESG to build alignment with the full array of stakeholders, from investors and ratings agencies to employees, customers and communities, and drive business performance.

Navigating the ESG disclosure process

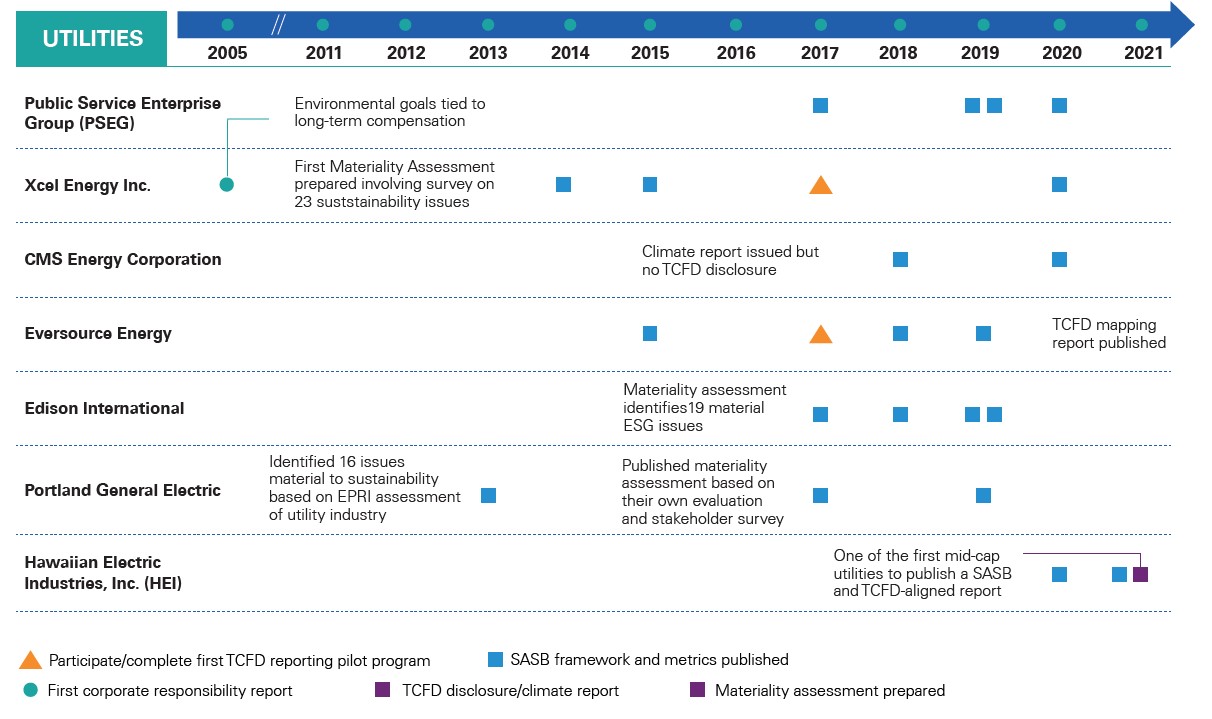

Utilities, especially the largest operators, have been filing voluntary ESG statements for several years. More recently, under pressure from investors, many are going beyond standard industry frameworks, such as those provided by the Edison Electric Institute and American Gas Association, among others, to meet guidelines set by the Sustainability Accounting Standards Board (SASB) and Financial Stability Board Task Force on Climate-Related Financial Disclosures (TCFD).

We help utilities navigate this complex and changing landscape, develop KPIs to measure progress, and build alignment on ESG issues with key stakeholders. We also help them create proper governance and risk-management processes and develop execution strategies to integrate ESG into the entire organization, from daily operations to long-term planning.

How ESG reporting has evolved at major utilities

Materiality assessments

In a materiality assessment, a company identifies and explores the full range of ESG issues that could affect the business or its internal or external stakeholders. In preparing materiality assessments, here are three pitfalls to avoid:

- insufficient engagement with a broad range of stakeholders.

- failing to build consensus among the senior executives and board members

- failing to translate ESG priorities into reporting strategy and corporate policies and practices.

SASB and TCFD reporting

SASB attempts to establish industry-specific standards for the disclosure of material ESG metrics and context, while the TCFD provides a framework to disclose climate-related risks and opportunities through existing reporting processes in four categories: governance, strategy, risk management and metrics and KPIs. We reviewed 19 recent utility SASB- and TCFD-aligned disclosures to understand the trends and challenges.

Strategy remains the least robust disclosure area in utilities ESG reporting—few firms consider their selected scenarios in the planning process or quantify the outcomes of these scenarios. In our review of 19 TCFD-aligned disclosures, we found that only six included any quantitative results of scenario analyses, and only nine disclosed both transition and physical risks. Eight said senior management was responsible for identifying and assessing climate-related risks and opportunities; 11 identified enterprise risk management (ERM) as the responsible body.

Common themes in climate risks and opportunities (TCFD reporting)

Climate related transition risk | Climate related physical risk | |

|---|---|---|

| Policy and legal | Technology | Acute |

|

|

|

Climate related opportunities

| ||

| Resource efficiency | Energy source | Products and services |

|

|

|

| Markets | Resilience | |

|

|

|

We expect reporting practices to coalesce around a single set of standards and become more comparable in the next few years. Until then, ESG standards will vary significantly and comparability within sub-sectors will be limited. In our view, the ideal metrics will be those that help key stakeholders understand how a utility will measure ESG progress consistently and transparently and translate insights into action and performance improvement, irrespective of the selected disclosure framework.

How KPMG can help

We provide clients with tools, frameworks and expertise to help improve their measurement, assurance and reporting capabilities. We offer guidance on which metrics to use, help utilities assess how their businesses may be impacted and perform in a range of climate scenarios, and craft a compelling narrative for every priority stakeholder, including institutional investors, ratings agencies, customers, communities, employees and potential recruits. We help companies integrate ESG considerations into ERM processes and help clients prepare, withstand and rapidly recover from strategic, operational, enterprise, and climate related disruptions. For clients that have already built strong ESG reporting foundations, we can help them execute broad ESG strategies.

Measure progress and tell your ESG story

Dive into our thinking:

Utilities and ESG

Download PDFSubscribe to KPMG ESG alerts

Sign up to receive ESG insights, information and event invitations from KPMG ESG. You'll get an email confirmation after subscribing.

Meet our team