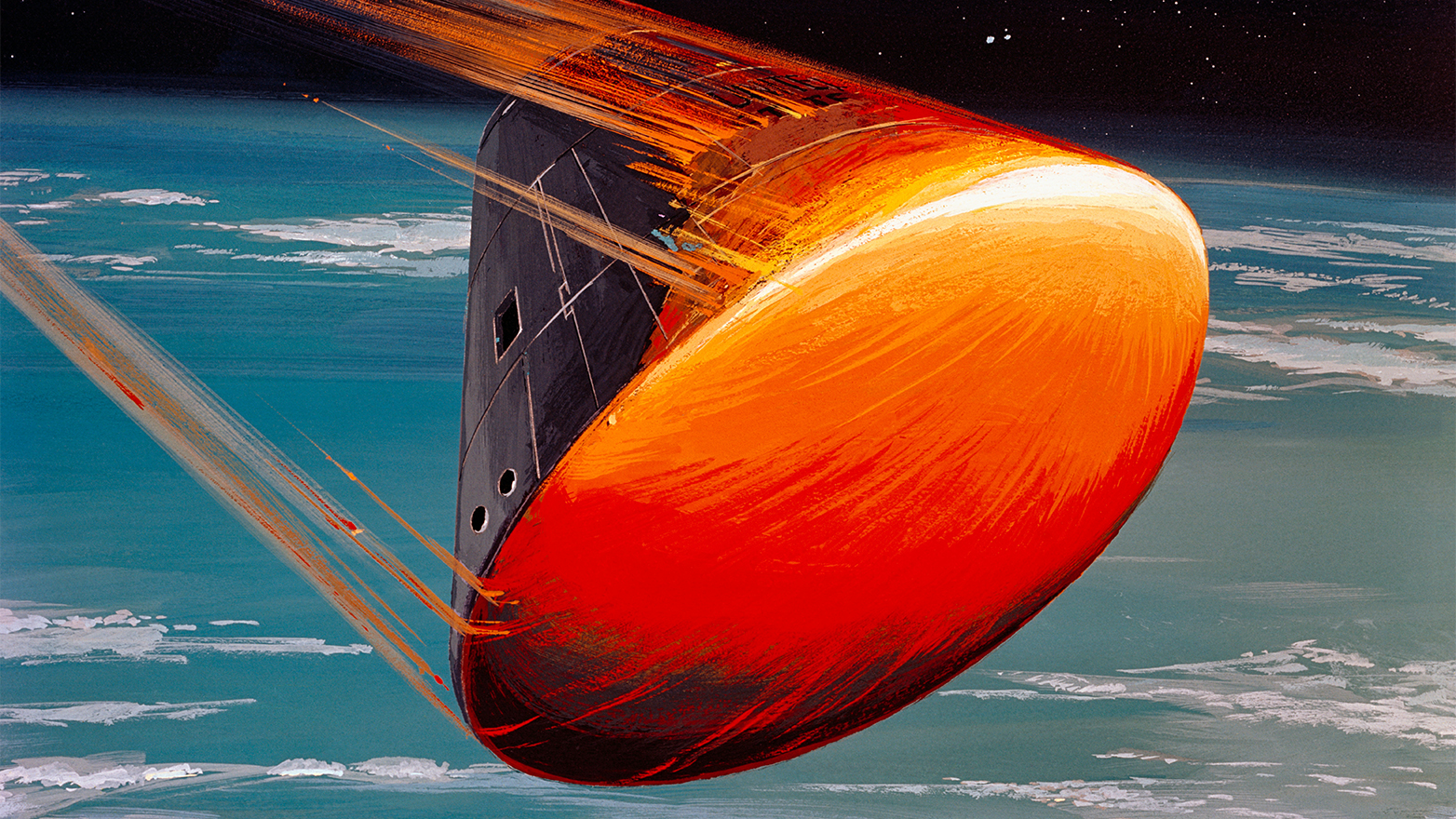

Frictions upon reentry: Three landing scenarios

I have spent the better part of the last four weeks in on and off-the-record meetings with economists, central bankers and finance ministers around the world. We have been assessing the potential spillover effects of recent financial market volatility.

I ended my tour at a U.S.-Canada summit the day after the president announced a joint mission to the moon with our neighbors to the North. It triggered images of the frictions upon reentry we have both endured, from geopolitical tensions to inflation, and the challenge of achieving a soft landing.

This edition of Economic Compass shares what I gleaned from those meetings. We have gamed out three landing scenarios:

- An immaculate disinflation, with our parachutes opening and a more or less graceful landing in cool waters.

- A “slowcession,” where the seas are more turbulent upon landing and rescue more difficult.

- A deeper, longer recession, which is akin to landing in the chill of colder Arctic seas.

The Federal Reserve has remained steadfast in its efforts to raise rates and combat inflation. This is despite the additional tightening of credit conditions in response to recent financial market turmoil and “risks…to the downside” on the economy.

The Fed has attempted to divorce policies to combat inflation from its efforts to stabilize financial markets. Breaking up is hard to do. Rapid rate hikes are destabilizing, while the Fed has repeatedly used rate cuts to restore liquidity and steady credit markets in the past.

That leaves us with the tail risk of a full-fledged financial market crisis, which is discussed in the last section of the report. The political brinkmanship surrounding the lifting of the debt ceiling could exacerbate volatility in the Treasury bond market. Liquidity in the Treasury bond market represents the oil of the market machinery; without it, the whole engine seizes.

Business investment remains in the red for much of the year, with problems in the commercial real estate sector.

Three scenarios

Chart 1 shows trajectory for growth under the three scenarios. The trajectory for growth goes from benign to painful. None of the scenarios include a full-blown financial crisis, which means that interest rates settle into a decidedly higher path medium term than we saw before the onset of the pandemic.

Chart 2 compares the unemployment rates of the three trajectories. Our base case is slightly worse than what was laid out by the Fed at its March meeting.

Why is the Fed still so focused on combating inflation by raising unemployment? Because officials worry that inflation is getting sticky, especially in the service sector, which accounts for over half of all inflation.

Recent research by the Kansas City Fed suggests that employment in the service sector, which feeds more directly into prices, is less sensitive to rate hikes than other sectors. The only way to fully derail service sector inflation is to overshoot and cause a larger pullback in employment in more interest rate sensitive sectors, such as housing.

The Fed’s Senior Loan Officer Survey revealed that lending standards had already tightened significantly by the end of 2022. Banks are strengthening their balance sheets with even tighter lending standards; the goal is to calm the frayed nerves of both depositors and investors.

Businesses with fewer than 250 workers, which accounted for a record breaking 71.4% of all job openings at the end of February, are particularly vulnerable to the current tightening cycle. That means employment will likely slow more than previously thought because those firms can no longer absorb the drop in job openings and layoffs at larger firms.

Scenario 1

An immaculate disinflation

The economy slows but does not contract. Real GDP rises at a 1.5% annual pace in 2023 after hitting 2.1% in 2022. The bulk of the slowdown is in mid to late 2023. The economy rebounds to a 1.9% pace in 2024:

- Consumer spending slows but does not collapse. Wages eventually move back above inflation, which triggers stronger growth in 2024.

- The correction in housing dissipates in the first half and then rebounds. Millennials aging into their prime home-buying years are expected to fuel those gains. Ongoing labor and materials shortages could limit the ramp up by builders.

- Business investment slumps but recovers by year-end as market volatility abates. Subsidies and incentives for electric vehicles and chip plants offset some of the weakness in commercial real estate.

- Inventories are drained but not fully liquidated; 2024 will be a year that inventories are rebuilt.

- Government spending slows after the bump due to the largest boost in social security payments on record. Infrastructure spending continues to ramp up. State and local government spending holds up better than federal spending.

- Trade is the primary drag on growth. The trade deficit widens as imports are expected to outpace exports.

The unemployment rate peaks at 4.1% in 2024, after hitting a low of 3.4% in January. That is not enough for the National Bureau of Economic Research (NBER)—the official arbiters of business cycles—to declare the slowdown a recession.

A 4.1% unemployment rate is well within the range that the Fed considers full employment. The increase in unemployment is expected to be triggered by a rise in attrition and slowdown in hiring rather than a surge in firing. Legal immigration is also starting to catch up after coming to a virtual standstill during the pandemic.

Wages cool to more sustainable levels as labor market demand and supply better align. There was some hint of that in the average hourly earnings data in the first quarter, although that data can be misleading.

Firms with monopsony power pass along those “savings” to consumers as their margins widen. That triggers a broader slowdown in price hikes. This is the reverse of what occurred as prices were rising or what former Fed Vice Chair Lael Brainard termed a “price/price” as opposed to a “wage/price” spiral.

The Fed is expected to wait until underlying inflation slips below 3% before cutting rates. Core personal consumption expenditures (PCE) inflation, which excludes food and energy, dips below 3% as we move into the fourth quarter of 2023.

Under Scenario 1, the economy is more prone to rebound and reflate. That makes the Fed reluctant to return to the ultralow rates we saw prior to the pandemic. The fed funds rate drops to a 3.25%-3.5% range by year-end 2024, 1.5 percentage points above February 2020 levels.

Chart 1 - GDP Forecast: Three Scenarios

Chart 2 - Unemployment Rate: Three Scenarios

Base case: Scenario 2

A slowcession

Our base case assumes that the Fed raises rates by another 0.25% in May. The additional tightening in the pipeline due to recent financial volatility is assumed to be equivalent to another half percentage point hike. Volatility in equity markets, which takes a toll on business confidence, escalates.

The economy essentially stalls out after a solid if not spectacular first quarter. The worst of the weakness occurs in mid 2023. Real GDP growth slows to a 1.3% annual pace in 2023 and slips below 1% in 2024:

- Consumer spending sputters to a standstill and remains stalled for several quarters. Consumers have already grown more cautious and stopped draining the excess savings they amassed during the pandemic in recent months; those reserves are concentrated in the savings accounts of higher income households, which tend to treat them more like wealth than savings.

- Housing remains in recession until late in the year, when mortgage rates come down and bring millennials back into the market. The single-family market drives those gains; the multifamily market struggles more with an overhang from the boom and tighter funding conditions for large developers.

- Business investment remains in the red for much of the year, with problems in the commercial real estate sector compounding the recent weakness in factory orders. Banks are less willing to keep potentially bad commercial real estate loans afloat.

- Inventories drain and remain subdued. Retailers and manufacturers are reluctant to pay the high costs of holding inventories with demand weak.

- Government spending slows but does not collapse. A deal to reduce the deficit to lift the debt ceiling means more restrictive fiscal policy in 2024 and 2025.

- Trade acts as a buffer to overall losses, with imports weakening more than exports and the trade deficit narrowing. Weak consumer spending and a draining of retail inventories, which are heavy on imports, trigger an actual drop in imports mid-year.

The unemployment rate peaks at 5.3% in 2024, more than enough for the NBER to declare a recession. Core PCE inflation cools to the low 2% range by year-end 2024. An extended period of consumer weakness erodes pricing power, while cost pressures abate. However, history suggests that inflation may prove to be stubborn.

The Fed is reluctant to cut rates until the 3% threshold on core PCE inflation is breached. That does not occur until the turn of 2023. The fed funds rate is forecast to drop to a 2.75%-3% range by year-end 2024, still 1.25 percentage points above pre-crisis levels.

Scenario 3

A deeper, longer recession

Scenario 3 includes a less orderly tightening of credit conditions. The Fed is expected to raise rates another 0.25% at its May meeting. We have assumed that the additional credit tightening triggered by recent financial market volatility equates to an additional one percentage point hike in the fed funds rate. The risk premium on equity prices remains elevated, which further tightens credit conditions.

The economy becomes a slow-moving train wreck. Growth stalls over the course of 2023 and contracts in the fourth quarter of 2023 and first half of 2024. Real GDP is forecast to rise by 1.2% in 2023, but drops by 0.4% in 2024:

- Consumers pull back, as unemployment mounts and credit conditions tighten.

- Housing sinks into a deeper recession, with tighter lending standards to builders exacerbating the pullback in construction due to demand.

- Businesses shelve investment plans in response to weak demand, tight credit and elevated uncertainty. Businesses dependent on ultralow rates go under, while commercial real estate losses compound.

- Inventories are liquidated, as businesses struggle with the costs of carrying inventories in the face of shrinking demand.

- Government spending fails to step up, given the rise in debt we have already accumulated and the effort to reduce deficits.

- The only offset is the trade deficit, which narrows. Imports are expected to fall in response to weak consumer demand and a sharper drop in inventories. Exports are expected to hold up better, as growth abroad outperforms the U.S.

The unemployment rate peaks at 5.8% in 2024, well above recession levels. Core inflation dips below 3% before year-end, which enables the Fed to cut rates more aggressively. The fed funds rate ends 2024 in the 2.25%-2.5% range, 0.75 percentage points above February 2020 levels. The risk is that inflation will cool more rapidly, and rates drop faster than forecast in the deep recession scenario.

Backlash to the Fed is expected to intensify as unemployment rises. The fact that 2024 is an election year further complicates the calculus for the Fed and should not be underestimated.

Even former Fed Chairman Paul Volcker, who was canonized for his relentless battle against inflation in the early 1980s, bowed to political pressure. He cut rates in mid-1980 before inflation was tamed, forcing him to reverse course and raise rates again late in the year.

The result was two back-to-back recessions in 1980 and in 1981-82. The consequences were horrific: unemployment peaked at 10.8% in 1982, long-term unemployment ballooned, workers were permanently sidelined and the drop in labor force participation by prime-age men accelerated. Joblessness in industrial meccas became generational.

Fertile ground for a crisis?

Financial crises tend to play out in fits and starts and are often dismissed, even after hitting critical stages. This underscores the importance of watching the aftermath of recent market turmoil.

Many, including the Fed, believed that the housing bust could have still been contained after Bear Stearns went under in early 2008, seven months before Lehman’s epic failure and the chaos that followed.

The good news is that the current situation does not resemble that of 2008-09. Household and corporate balance sheets are in much better shape; lending standards are much stricter than they were during the subprime crisis. Homeowner equity is now larger.

The commercial real estate market is in more precarious shape, given the pivot to work from home and the backlog of leases poised to reset. Even firms that are pushing their workers to come back are reducing their office footprints.

Economic activity is shifting out of urban centers to the suburbs and second-tier markets. That will stress the finances of what were some of the hottest cities prior to the pandemic.

The timing of the debt ceiling debate is particularly worrisome as it could trigger yet another surge in rates. That would further stress liquidity at a time when financial markets are still recovering from the fragilities that rapid rate hikes revealed. We have an entire economy that has come of age in an era of ultralow rates and almost glacial economic growth.

That has now reversed, while geopolitical tensions and a rise in nationalism have thrown a monkey wrench in globalization. Those shifts could challenge the value of some long-term investments.

Treasury Secretary Janet Yellen recently called out the surge in deposits in uninsured money market mutual funds as an area to watch. A jump in rates may reveal larger-than-expected losses in assets that are no longer feasible and cause highly fungible deposits to flee. That could trigger fire sales and losses that cascade across the global financial system.

This is in addition to vulnerabilities in the Treasury bond market. Liquidity dipped to the lows reached at the onset of the pandemic in recent weeks. Trades that took seconds to clear one day took minutes the next; that is an eternity today in a financial system that has proven it can shift more rapidly than most expected.

The challenge for the Fed will be to stabilize financial markets without further stoking inflation. The Fed will be reluctant to cut rates to zero, short of a full-blown crisis.

A deliberate default on our debt would be catastrophic. Rates would spike, the dollar depreciate and losses reverberate around the world.

The Fed will likely be forced to step in to buy Treasuries. That would fuel a vicious cycle of stagflation. My brain hurts even thinking about it. We have been through enough in recent years and I hope Congress represents enough of our collective interests to avert such an outcome.

Bottom Line

I remember sitting in the audience at a policy conference for the National Association for Business Economics (NABE) on March 21, 2022. Chairman Jay Powell got up to talk about the economic outlook and the course of monetary policy.

Powell made headlines by warning that rate hikes would be faster and stay higher for longer to derail inflation. One word stood out, in a room full of people paid to literally dissect every word he utters. He said the landing could be “soft-ish.” That meant the Fed was willing to trigger a recession to derail inflation.

Many have grown weary of waiting for what has been described as the most anticipated recession on record. It reminds me of Joseph Heller’s saying in the book Catch 22, “Just because you are paranoid, doesn’t mean they aren’t after you.”

We have emerged from the pandemic and our heat shields have held, for now. We have yet to deploy our parachutes and splash down. The waters are forecast to be frigid and turbulent. The journey back to the earth as we know it will be bumpy. We will likely suffer more of a chill before we can be retrieved.

Dive into our thinking:

Frictions upon reentry: Three landing scenarios

Download PDFExplore more

Meet our team

Subscribe to insights from KPMG Economics

KPMG Economics distributes a wide selection of insight and analysis to help businesses make informed decisions.