The Fed’s final round… Special biannual report

The economy will slow into the first half of 2024.

December 11, 2023

On a recent flight to Las Vegas for a speech, I found myself scrolling through clips from Sylvester Stallone’s epic Rocky franchise. I was trying to think of ways to explain the next round of the Federal Reserve’s battle against inflation, the endurance the economy has shown and how a soft landing is not the same as no landing.

Rocky’s first matchup with Apollo Creed offered a good metaphor. The night prior to the fight, Rocky realizes that he can’t beat Creed but he can “go the distance,” defy the odds and remain standing when the bell on the final round rings; that is something no one else had ever accomplished against his opponent.

How much more of a beating can the economy take and remain standing? Thus far, we have been remarkably resilient, with inflation cooling at its fastest pace outside of a war or a full-blown recession. The back-to-back recessions of the early 1980s under former Fed Chairman Paul Volcker were particularly brutal and left deep scars, especially on the complexion of the industrial Midwest. Many of those wounds and the setback that workers endured in the wake of bursting bubbles persisted and compounded over time.

Wage inequality worsened over the last two decades. That contrasts with what we saw at the end of the 1990s boom. For a few years, inequality diminished as a surge in productivity justified higher wages. We sailed through the threat of Y2K (a glitch in computer programs that threatened to leave us in the dark). In response, consumer sentiment soared to a record high in January 2000.

That hasn’t happened this time, despite the most rapid recovery on record. Consumer attitudes remain subdued and more consistent with a recession than a recovery.

The old adage “Tis better to have loved and lost, than never to have loved at all” does not apply to the economy. Low-wage frontline workers went from replaceable to essential. Their wages were leveled up as they moved from the shadows of the economy into the sun, only to be burned by inflation.

Inflation, or the pace of price increases, slowed but the level of prices remain high; that is constraining the ability to make ends meet. Millennials, who now dominate the labor force, graduated into the Great Recession and the subpar recovery that followed. That set back their lifetime earnings as they were forced to take any job, not necessarily the jobs for which they were best qualified. They got a break and rushed to buy homes as mortgage rates plummeted when the economy initially reopened, only to have their dreams of home ownership dashed by a sharp erosion in affordability. Is it any surprise that millennials are among the most dissatisfied with where we are?

This special edition of Economic Compass takes an in-depth look into what to expect in 2024 by sector. Special attention will be paid to how those shifts will affect the trajectory of inflation and by extension, interest rates.

The Fed is clearly pleased at the progress we have made on inflation but will not declare victory and cut rates until it is certain we are headed to a more sustainable path on inflation. That means quarters, not months, of inflation cooling more rapidly than wages so the purchasing power lost to inflation can be restored. We are getting closer to a turning point on rates and a time when inflation is less of a reality and more of an unpleasant memory associated with the pandemic.

2024 Outlook

A rocky road

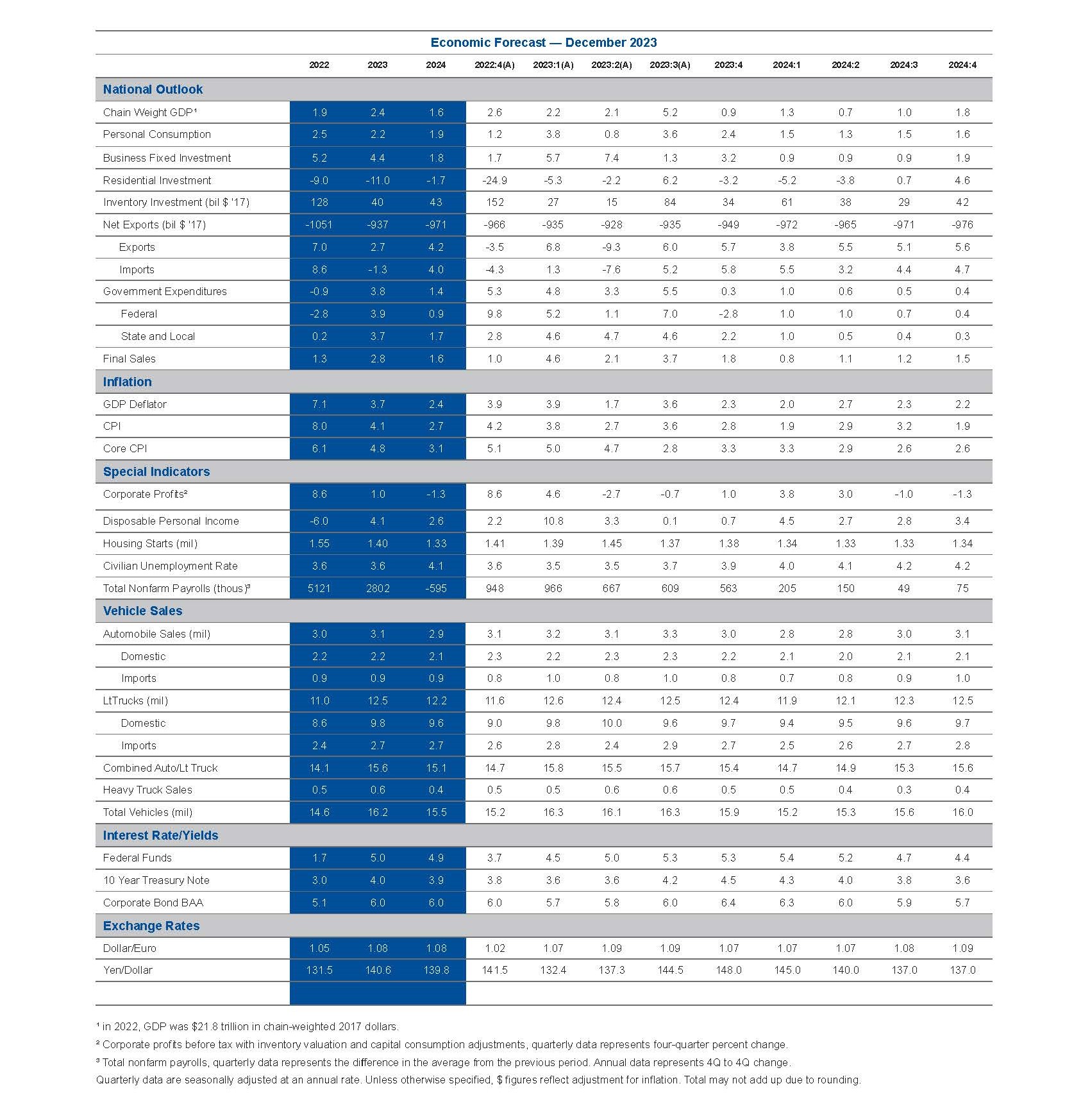

Chart 1 shows the forecast for growth in 2023 and 2024. Buckle up. The economy is expected to slow, abruptly, starting in the fourth quarter. Growth is expected to slip below potential for most of 2024. It is expected to accelerate again late summer and into the fall.

That slowdown in growth is expected to cause employment to stall but not contract. The unemployment rate is forecast to edge up to 4.2% by year-end 2024, slightly higher than the 3.7% of November 2023. That is well below the level consistent with a recession but could still hurt. The ranks of the long-term unemployed are creeping up, which means it is harder for those who lose a job to replace it. Job openings dropped to 1.3 per job seeker in October 2023, closer to the level we saw pre-pandemic.

Risks: Most soft landings are derailed by an external shock. It wouldn’t take much for an economy growing at less than 1% to slip through the ice. Employment in the most interest-rate sensitive sectors has already stalled, while the full force of headwinds associated with rate hikes has yet to hit. This is at the same time that China is struggling to boost growth after being the driver of economic gains for much of the 2000s.

Economic winners and losers

Consumer spending is expected to slow but not collapse. Delinquencies on credit cards and vehicle loans have picked up but actual defaults remain low. Lenders are more willing to work with borrowers than in the past, while those most reliant on their vehicles to get to work will skimp elsewhere to prevent losing their transportation to and from work.

The resumption of student loan repayments is a headwind but not the cliff event many feared. Income-based repayment schemes, some loan forgiveness and a year’s grace period on defaults are softening the blow to spending.

The savings amassed during the pandemic is dwindling. Much of what is left is concentrated in households in the top two income quintiles. Credit card delinquencies in the third income quintile rose along with subprime delinquencies over the summer.

The largest drag is expected to come from the high cost of financing big-ticket items and the sharp slowdown in employment. Wages and new paychecks are expected to slow.

Spending on goods is expected to be hit harder than spending on services. Everything from spending on restaurants to haircuts and tickets to big events doesn’t tend to be financed. Although, after looking up the price of Super Bowl LVIII in Las Vegas, they might as well be. Tickets begin at more than $7000 apiece; that is before the teams who will face off have been determined. Some may be hoping for a Taylor Swift appearance if the Kansas City Chiefs play.

That is a testament to the outsized role wealthier households play in spending; all-cash purchases have moved from 15% to 20% of vehicle sales, while tourists are paying up to ride in the front of the plane.

Spending on healthcare is structural and rising with the aging of the baby boomers into retirement. They are moving onto Medicare as their health problems are compounding. Most forget that the largest driver of federal spending is the aging of the population and the boost to spending on Social Security and Medicare, not defense, foreign aid, the poor or children.

Housing gets worse before it gets better. Mortgage applications plummeted to multi-decade lows in September and October as mortgage rates soared. Some of the hottest pandemic markets chilled. Austin and Boise have been hardest hit. Miami and much of Florida remain hot for the well-to-do.

A move by builders to develop smaller, more afforable homes and offer mortgage discounts to keep first-time buyers in the market is blunting the blow of higher rates. Lower material costs are another plus, but labor is scarce and expensive. Large builders are holding up much better than smaller builders. The latter rely more on bank credit, which has tightened significantly.

The same is true in the multifamily market. Apartment rents have begun to roll over, which has made banks even more cautious on lending. However, hurdles to ownership will buoy the demand for rentals for some time to come.

Pent-up demand for single-family homes remains robust, with millennials aging into their prime home buying years. Housing activity is expected to gradually recover as mortgage rates start to fall in late spring and early summer. It will take years for supply to rise to the level of demand. That will boost consumer attitudes as well.

Rates and prices would both need to fall to unleash the pent-up demand for home ownership by millennials. That is a multi-year process and partly contingent upon older homeowners opting to sell. The silver lining is that baby boomers who have locked into low rates or paid off their mortgages are already helping their millennial children buy their first homes.

Chart 1: Economy poised to slow

Real GDP, annualized percent change

Business investment cools. A surge in investment triggered by the Inflation Reduction Act (IRA) helped spur business investment in the final quarter of the year. Construction of chip plants is on a tear, although no one is quite sure where the labor to staff those plants will come from.

The scramble to adopt and leverage generative AI (GenAI) has also tipped off a flurry of new investment. The frenzy resembles the tech bubble of the 1990s. Everyone scrambled to upgrade computers and equipment, but it took time to fully harness the power of the internet and the faster computing associated with more sophisticated chips.

It usually takes a decade for an open use technology like GenAI to move from innovation to commercialization. The pivot to GenAI could be more rapid, given the ease of use and the stunning surge in productivity associated with the technology.

With every technological innovation we tend to see offsetting shifts in the demand for workers, with lower skilled workers replaced by higher skilled workers. GenAI works at both ends of the skills strata, which makes its impact on the labor market more complex than many assume. The tire tends to meet the road on productivity growth when technology is used to enhance jobs, not just replace workers. The first hurdle is to get workers to adopt new technology; that is easier if it doesn’t make their jobs obsolete.

Another hurdle is computing power and the power needed to run large language learning models. This gives larger firms, notably in the tech space, with better developed supply chains and self-sustaining energy grids, a leg up over small and midsized firms.

The energy sector is expected to place the largest drag on business investment in 2024. Output remains strong, but investment in new drilling and renewables is constrained. West Texas Intermediate oil prices fell below breakevens, which means less capital spending on carbon and green energy projects. The large oil producers are some of the largest investors in renewables.

Separately, investments in renewables triggered by the IRA are being delayed by the high cost of capital and domestic content rules. China dominates the supply chain for solar panels and the rare earths needed for electric vehicles.

Lastly, the commercial real estate market is showing further signs of stress. Real estate developers are starting to return their keys to lenders, also known as “jingle mail,” as the costs of maintaining properties exceed revenues. That hits investment in two ways, by tightening lending standards and delaying or canceling new projects.

Inventories will be slow to rebuild. Conservative ordering for the holiday season triggered a sharp drawdown in inventories at the start of the fourth quarter. The Detroit Big Three are pushing to recoup strike losses, but gains will be limited. The pandemic taught us that plants are easier to shutter than reopen. Maintenance deferred when plants were idled will need to be completed.

Higher interest rates, tighter lending by banks to fund inventories and escalating insurance costs are all hurdles to stocking up. The push is back to just-in-time. Inventories are expected to remain low until late in the year, when demand and production both are expected to pick up again.

Government spending slows to a crawl. A combination of continuing resolutions, the suspension of funding for the war in Ukraine and the end to COVID-era stimulus have already put the brakes on government spending. The largest single boost to spending is expected to be the bump to Social Security payments, which covers more baby boomers but is scheduled to rise less rapidly in early 2024.

Funding for state and local governments, which represents the lion’s share of government spending, is also constrained. Everything from corporate tax revenues to those from retail sales is expected to slow. Many states still have rainy day funds accumulated during COVID but those funds are being drained.

Those shifts are all occurring at the same time that higher rates and mounting debt are increasing the share of revenues allocated to the cost of government borrowing. That leaves less room to respond to external shocks as they arrive.

The trade deficit widens. The U.S. is expected to remain stronger than most of our counterparts abroad. Those shifts, coupled with the lags in the dollar, which strengthened in 2022 and 2023, are expected to keep imports outpacing exports in 2024. Travel abroad, which remains robust, is counted as an import.

Inflation cools

Chart 2 shows the forecast for the core personal consumption expenditures (PCE) index, which excludes food and energy. That is the Fed’s favored measure as it is the best predictor of future inflation. Much of the slowdown in inflation has been due to an unfurling of supply chain snags. A strong dollar should help the ongoing cooling of goods prices.

The stickiness of home ownership costs has raised a red flag for some on the Fed and made them cautious about declaring victory too soon. A rebound in home values could stem the improvement in shelter costs related to falling apartment rents. There are major differences by area. Some of the hottest Texas markets saw the largest amount of overbuilding in recent years, while places like Chicago have very little new supply.

The key concern is core service sector costs, which strip out shelter costs and still account for about half of PCE inflation. That includes everything from airfares, hotel rooms, short-term vacation rentals to haircuts, household services and healthcare.

Companies that absorbed the rise in healthcare costs when the labor market was tighter and competition for workers more intense are now sharing more of those costs with employees. That shift, a consolidation of healthcare providers, especially in rural areas, changes in the model for healthcare, ongoing labor shortages and the aging of the baby boom into retirement are all stressing the system and could create a floor under service sector prices.

Risks: A full-blown recession would cool inflation more rapidly than a soft landing.

Chart 2: Inflation continues to cool

Core PCE, 4Q/4Q % change

Higher for long enough?

Chart 3 shows the forecast for the fed funds rate through year-end 2024. The Fed would like to see core inflation well below 3% before it cuts rates. That is expected to occur in the first half of the year. The first rate cut is now projected for the May Federal Open Market Committee (FOMC) meeting.

The descent on rates is expected to be much slower than the ascent. The noninflationary or neutral fed funds rate has likely moved up, closer to 3%. The fed funds target was 1.5%-1.75% in February 2020.

Rates are not likely to return to the zero lower bound as they did in the 2010s unless we enter yet another financial crisis. The ultralow rates of the 2010s were an anomaly, not the norm.

The Fed is expected to continue its balance sheet runoff through 2024 and into the first half of 2025. It has already reduced its balance sheet by more than $1 trillion over the last year. That is expected to keep mortgage rates and long-term bond yields from falling as low as they did at the start of the recovery, when the Fed was actively buying mortgage-backed securities and Treasury bonds.

Risks: The worst mistake a central banker can make is to cut rates too soon and allow inflation to become entrenched. The risk is that the Fed holds rates too high for too long. A recession would trigger a more rapid cut in rates than forecast.

Chart 3: Descent on rates slower than ascent

Percentage point change in fed funds rate from first rate hike

Treasury bonds rally

Chart 4 shows the forecast for the yield of the 10-year Treasury bond. Long-term rates are expected to fall with the easing of inflation and a cut in short-term rates but not to the lows we saw at the onset of the recovery. Treasury bonds have already rallied and yields fallen from their peak of 5% in October. Look for rates to rise a bit before falling more persistently as we move into 2024.

Buyers in the Treasury bond market are now dominated by private sector investors instead of central banks. That shift in the composition of demand has made the Treasury market more skittish and susceptible to shocks. Escalating federal deficits and the push by the Fed to reduce its balance sheet could form a floor under long-term rates.

Risks: A recession would push rates lower than forecast. The reserve currency status of the U.S. dollar could also push yields lower. Investors still fly to the safety of the U.S. Treasury bond market anytime there is trouble.

Bottom Line

The Fed is about to enter the final round of its battle against inflation. That will test our endurance and brings me back to Sylvester Stallone’s alter ego, Rocky. He came to embody the concept of endurance. When he decided to get into the ring one last time in the sixth installment of the Rocky franchise in 2006, he uttered his most famous line. “It ain’t about how hard ya hit. Its about how hard a hit you can get and keep moving forward.”

That is exactly what the forecast for 2024 is about. We have proven ourselves a worthy adversary against just about everything the Fed has dealt us. It is in that endurance that I find hope that more of us will still be standing when the final bell rings in the Fed’s fight against inflation. That is when we will be able to heal and feel better about where we are and where we are going.

Bottom Line

The Fed is about to enter the final round of its battle against inflation. That will test our endurance and brings me back to Sylvester Stallone’s alter ego, Rocky. He came to embody the concept of endurance. When he decided to get into the ring one last time in the sixth installment of the Rocky franchise in 2006, he uttered his most famous line. “It ain’t about how hard ya hit. Its about how hard a hit you can get and keep moving forward.”

That is exactly what the forecast for 2024 is about. We have proven ourselves a worthy adversary against just about everything the Fed has dealt us. It is in that endurance that I find hope that more of us will still be standing when the final bell rings in the Fed’s fight against inflation. That is when we will be able to heal and feel better about where we are and where we are going.

Dive into our thinking:

The Fed’s final round...Special biannual report

Download PDFExplore more

KPMG Economics

A source for unbiased economic intelligence to help improve strategic decision-making.

After the fall: A structural change watch list

Inflation and higher rates are plaguing developed and developing countries alike.

Retail therapy… The outlook for the U.S. consumer

A soft landing is possible and even probable…but our journey is not yet done.

Meet our team

Subscribe to insights from KPMG Economics

KPMG Economics distributes a wide selection of insight and analysis to help businesses make informed decisions.